The electricity grid in the Baltic region was constructed in the Soviet-era. Once a grid is established, making changes is costly and time-consuming. Despite independence, Baltic States renewed the BRELL agreement (Belarus, Russia, Estonia, Latvia Lithuania) in 2001, maintaining a system which requires Russian operators to control frequencies and balance supplies. In 2007, Baltic States confirmed their ambition to join the Continental Europe Synchronous Area (CESA). Formal agreement in Brussels in 2019 commenced one of the largest infrastructure programmes in the region’s history, aimed at rerouting and upgrading the grid. Desynchronisation is set for 8th February 2025. The Baltics will operate as an energy island before connecting with CESA the following day. By completion, total programme cost will be €1.6 billion (approximately 75% funded by EU grants). [1]

Current Situation Analysis

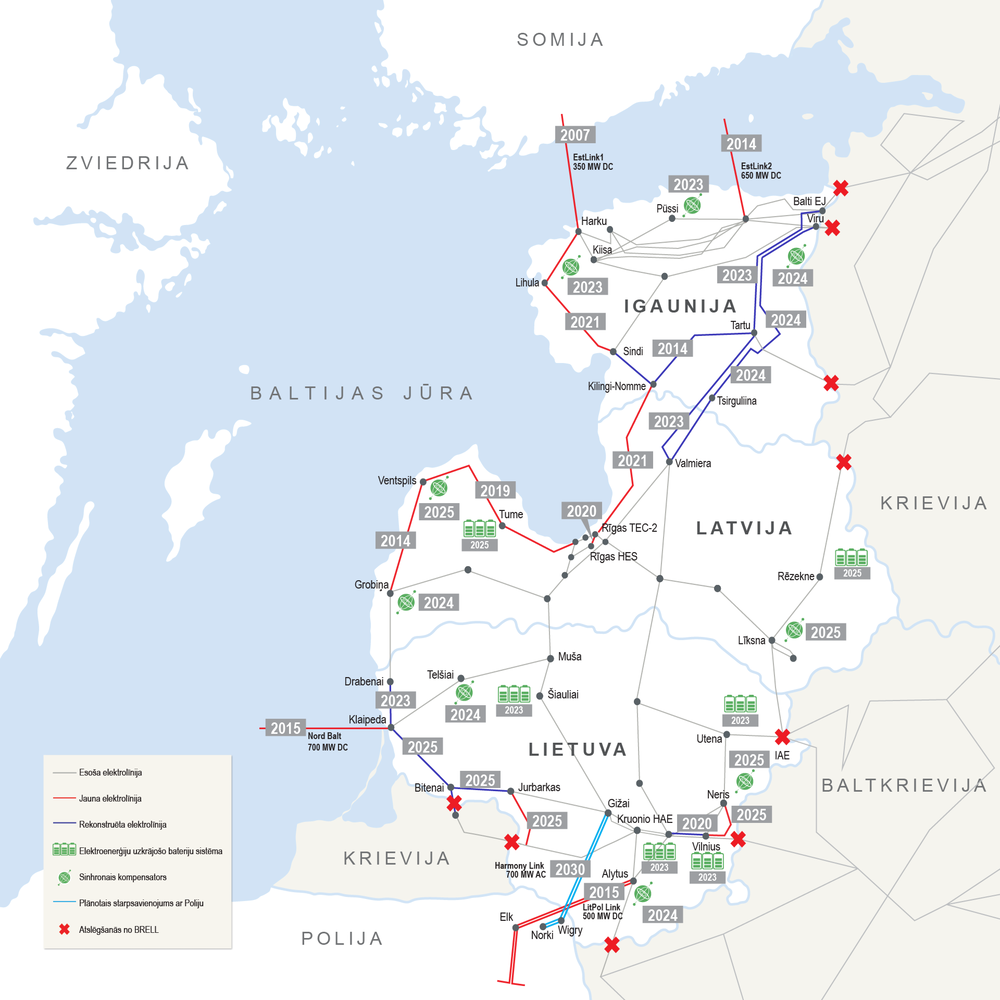

The programme consists of over 20 projects to strengthen the Baltics’ electricity network. New high voltage transmission lines have been constructed to carry power through the region. These also facilitate interconnection with EU neighbours, with one project expanding the LitPol Link between Lithuania and Poland. Nine synchronous condensers and six large-scale battery storage systems (some scheduled for 2025) have been introduced. [2] Condensers (giant wheels in constant rotation) provide instantaneous energy to the system or absorb excess in times of stress. Batteries respond to short-term changes in supply and demand. Together, they will help maintain frequency and system balance. In addition, nine connections with Russia and Belarus will be disconnected (See Annex A).

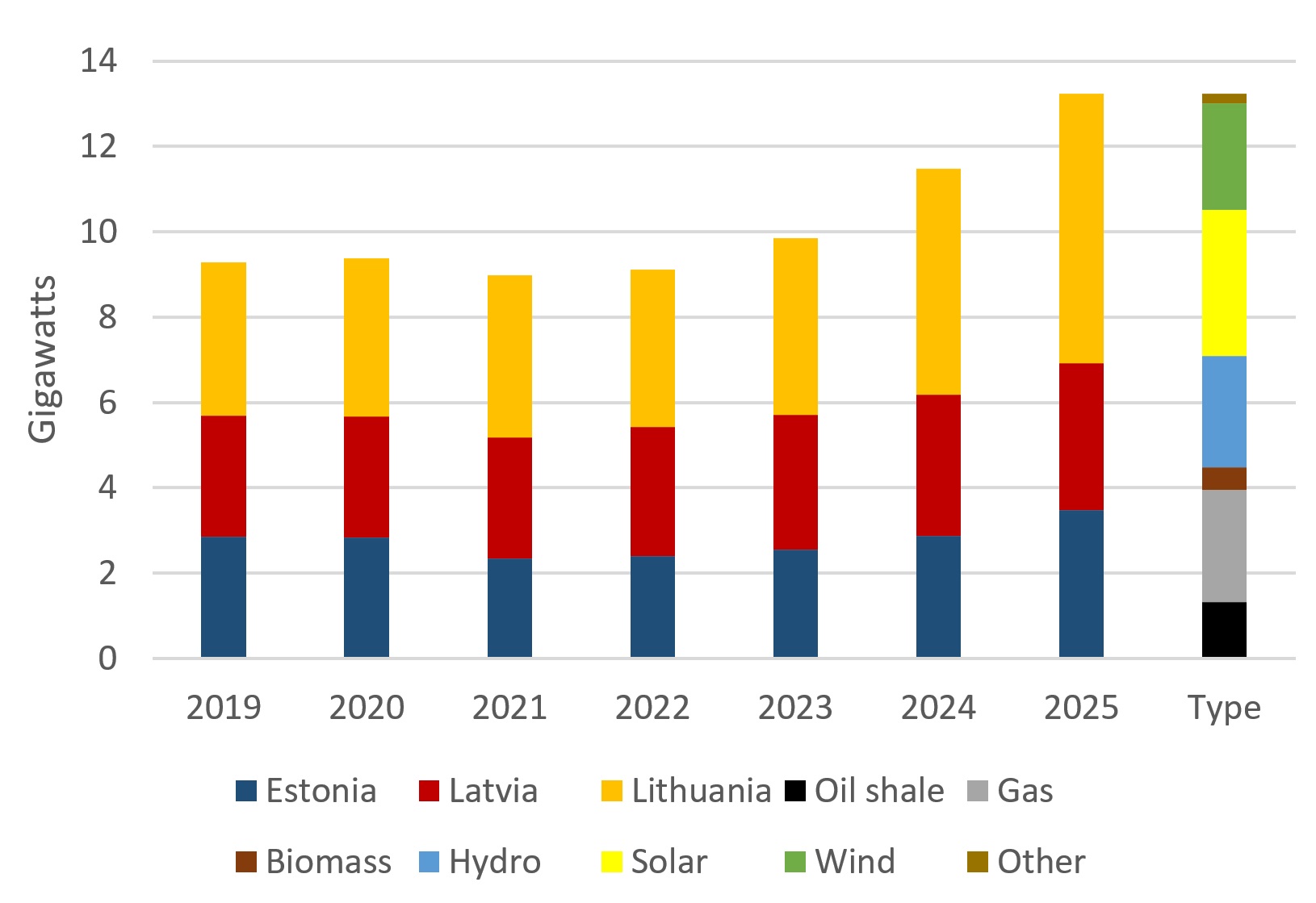

Figure 1: Baltic Installed Electricity Generation (2019-2025) & Breakdown

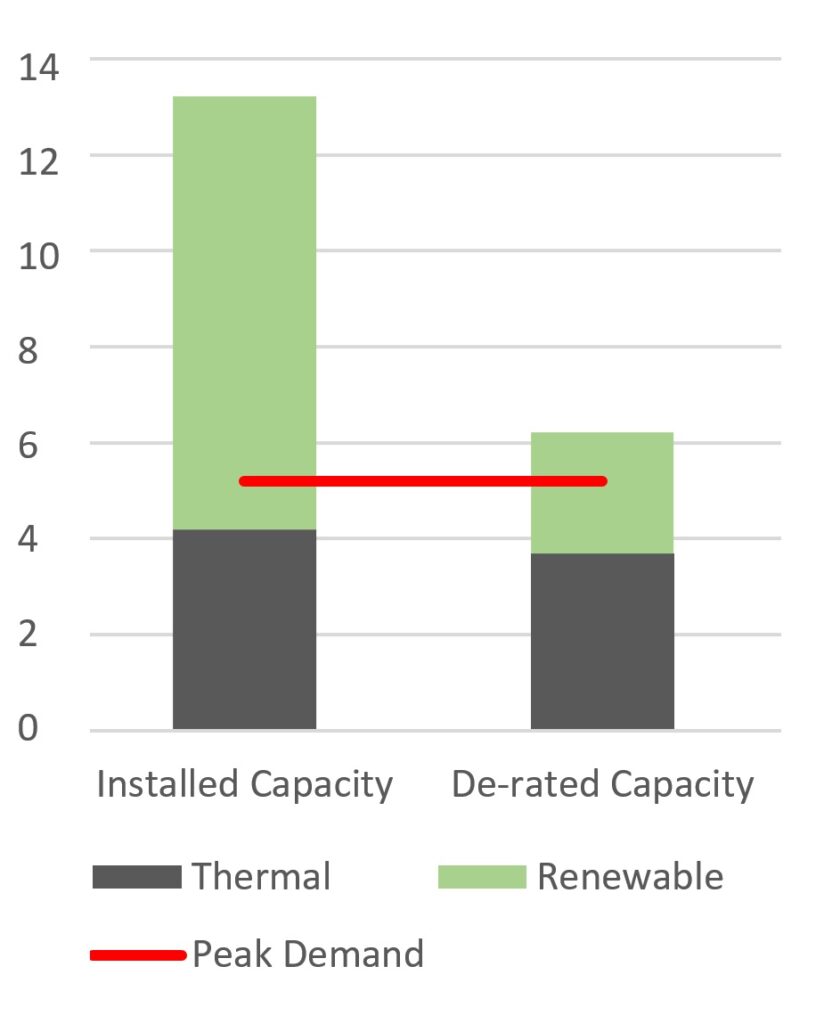

Figure 2: Baltic Electricity Capacity Margin

Source: NATO ENSEC COE Analysis of ENTSO-E Transparency Platform [3]

Since the programme’s commencement, the Baltics have increased electricity generation capacity by 42%, now totaling over 13GW. Growth has primarily been driven by renewables, particularly wind and solar (Figure 1). However, renewables depend on the weather. The capacity factor for renewables in the region (how much they actually generate versus the installed maximum) is 28%. Oil shale & gas generators have higher availability and can be turned up and down at short notice. De-rated capacity (how much generation we could expect in times of high demand) is 6.2GW, healthily above the 5.2GW peak demand the TSOs have calculated. [4] Importantly, this does not include potential supply from EU neighbours, which provides extra contingency.

The Baltics share interconnection with Sweden (0.7GW), Poland (0.5GW), and Finland (1GW). A further 0.7GW is planned between Lithuania and Poland (‘Harmony Link’, originally planned to be a marine cable, will now be developed over land).

In addition to infrastructure changes, the programme includes several market reform projects, including the planned launch (February 2025) of a frequency reserve capacity market. [5] This is to ensure it is economically viable for market participants to provide the system with energy in times of stress. Baltic electricity TSOs have signed a regional system management agreement, which describes the principles of cooperation after the synchronisation. [6] Its purpose is to ensure reliable operation, optimal management and technical development of the Baltic States’ electricity systems.

Challenges

Despite adhering to contractual obligations, it is possible that Baltic States may face targeted disruption to their electricity networks as a result of BRELL disconnection. Geopolitical commentators have highlighted the risk that Russia will unilaterally disconnect from the BRELL system in advance of the target date, motivated by the risk to their reputation. [7] They have also noted the precedent of sabotage and cyber-attacks to the Baltic States during disagreements with Moscow. [ibid] With no land border between Kaliningrad and mainland Russia, Kaliningrad will also disconnect from BRELL at the same time. Russia has built new coal and gas stations in Kaliningrad to prepare extra capacity to run as an island. Concerns about the security of subsea electricity cables have also been raised, with several recent disruptions to the interconnector with Finland. [8] 77% of interconnection capacity between the Baltic States and EU neighbours is made up of subsea cables.

All three countries have carried out advanced contingency planning, such as testing isolated operation of their own power systems to ensure they can run without BRELL connection. [9] In 2023, average hourly consumption across the year in the region was 2.8GWh. [10] Figure 2 demonstrates that, barring significant simultaneous disruption to multiple elements of the system, the Baltics are in a strong position to be able to meet demand after BRELL desynchronisation.

Nonetheless, interconnection with EU neighbours provides desirable contingency. Recent damage to the Estlink-2 interconnector means a loss of 0.65GW potential supply for the remainder of this winter, with repairs to take ‘several months’ according to Finnish TSO Fingrid. [11] While Estonian TSO Elering is confident this will not negatively impact desynchronisation [12], its timely repair will take some pressure off the Baltic system.

Gap Analysis & Next Steps

The 20 projects agreed under the synchronisation programme have largely proceeded without fault. Primary disruption has been in the construction of the Harmony Link between Poland and Lithuania. Originally intended to be a marine cable, this idea was scrapped in April 2023 owing to a “significant increase in costs and orders for submarine cables and converter stations.” Given the recent vulnerabilities seen in subsea cables, this is not a bad development. However, the problem lies in the timeline: the engineering plan for an overland cable will not be completed until the end of 2026. Harmony Link has the potential to increase interconnection capacity with EU neighbours by 32%, and entirely via overland connection. Completion of this project must therefore be facilitated.

Nonetheless, it is likely that, without large-scale and targeted disruption to the regional network, the Baltics will be able to comfortably balance electricity supply with demand after BRELL disconnection. The programme’s completion will significantly reduce Russia’s direct influence, bolstering sovereignty and security. [13]

Annex A: Map of Baltic Electricity Network & Synchronisation Projects

Source: Latvian TSO [2]

Bibliography

- [1] Litgrid, “Synchronisation,” [Online]. Available: https://www.litgrid.eu/index.php/synchronisation/synchronisation/31363. [Accessed January 2025].

- [2] AST, “The Importance of the Project,” [Online]. Available: https://ast.lv/lv/projects/projekta-nozime. [Accessed January 2025].

- [3] ENTSO-E, “Installed Capacity per Production Type [14.1.A],” [Online]. Available: https://transparency.entsoe.eu/generation/r2/installedGenerationCapacityAggregation/show. [Accessed January 2025].

- [4] Elering, “Estonian Electricity Security Report,” 2024.

- [5] ERR, “Baltics’ frequency reserve capacity market to open February 4,” [Online]. Available: https://news.err.ee/1609514611/baltics-frequency-reserve-capacity-market-to-open-february-4. [Accessed January 2025].

- [6] R. o. L. E. Ministry, “Baltic electricity transmission system operators agree on cooperation in system management after synchronization,” [Online]. Available: https://enmin.lrv.lt/lt/naujienos/baltijos-saliu-elektros-perdavimo-sistemu-operatores-susitare-del-bendradarbiavimo-sistemos-valdyme-po-sinchronizacijos/. [Accessed January 2025].

- [7] S. Fang et al, “Electricity grids and geopolitics: A game-theoretic analysis of the synchronization of the Baltic States’ electricity networks with Continental Europe,” Energy Policy, 2024.

- [8] L. Institute, “NATO’s best-laid subsea cable security plans,” [Online]. Available: https://www.lowyinstitute.org/the-interpreter/nato-s-best-laid-subsea-cable-security-plans. [Accessed January 2025].

- [9] Litgrid, “Isolated operation test of the power system of the Republic of Lithuania,” [Online]. Available: https://www.litgrid.eu/index.php/synchronisation/synchronisation-projects/isolated-operation-test-of-the-power-system-of-the-republic-of-lithuania/32028. [Accessed January 2025].

- [10] Eurostat, “Supply, transformation and consumption of electricity”.

- [11] Fingrid, “Estimate of the sufficiency of electricity for the current winter,” [Online]. Available: https://www.fingrid.fi/ajankohtaista/tiedotteet/2025/fingrid-on-paivittanyt-arviotaan-sahkon-riittavyydesta-kuluvan-talven-ajalle-estlink-2–yhteyden-vikaantuminen-heikentaa-sahkon-riittavyytta-erittain-kylmana-ja-tyynena-talvipaivana/. [Accessed January 2025].

- [12] Elering, “The suspected fault in EstLink 2 is located on the seabed of the Gulf of Finland,” [Online]. Available: https://elering.ee/en/suspected-fault-estlink-2-located-seabed-gulf-finland.

- [13] C. f. E. P. Analysis, “Baltic Power Shows Way on Hybrid Threats,” [Online]. Available: https://cepa.org/article/baltic-power-shows-way-on-hybrid-threats/. [Accessed January 2025].

- [14] Litgrid, “Capacities’ impact on price,” [Online]. Available: https://www.litgrid.eu/index.php/electricity-market/capacities-impact-on-price-/32112. [Accessed January 2025].

- [15] Litgrid, “Harmony Link,” [Online]. Available: https://www.litgrid.eu/index.php/tinklo-pletra/strateginiai-projektai/harmony-link/20075. [Accessed January 2025].